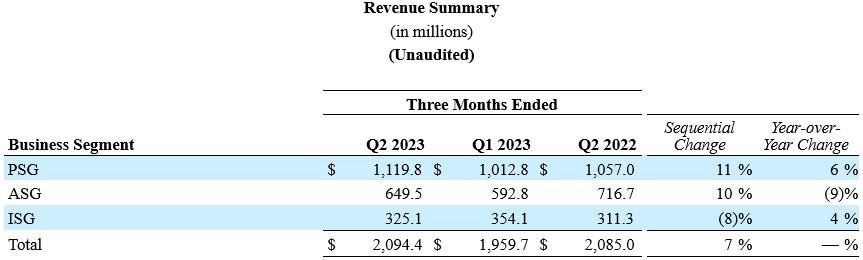

Automotive and Industrial end-markets drive growth and contribute 80% of revenue

SCOTTSDALE, Ariz, – July 31, 2023 – onsemi (the “Company") (Nasdaq: ON) today announced results for the second quarter of 2023 with the following highlights:

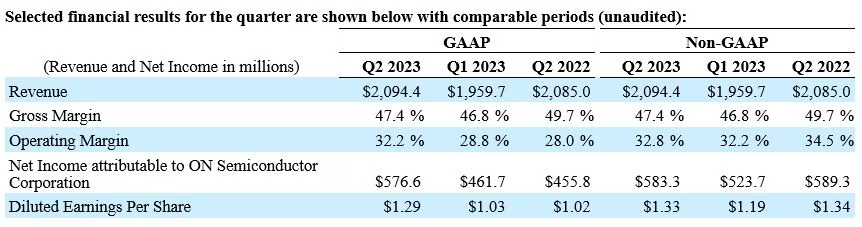

- Revenue of $2,094.4 million, flat year-over-year

- GAAP and non-GAAP gross margin of 47.4 percent

- GAAP operating margin and non-GAAP operating margin of 32.2 percent and 32.8 percent respectively

- GAAP diluted earnings per share of $1.29 and non-GAAP diluted earnings per share of $1.33, approximately flat compared to $1.34 in the quarter a year ago

- Record Automotive revenue exceeded $1 billion increased 35% year-over-year

- Industrial revenue of $609.3 million increased 5% year-over-year

- Silicon carbide revenue grew nearly 4x year-over-year

“onsemi delivered another excellent quarter, ahead of guidance on revenue and earnings per share, driven by growth in automotive and industrial. Our operational excellence and winning formula have proven to be the right strategy in sustaining our financial performance amid a soft macroeconomic environment", said Hassane El-Khoury, president and chief executive officer of onsemi. “Our brownfield capacity expansion is creating an opportunity for onsemi to gain share in silicon carbide by capitalizing on the rapidly accelerating demand for electrification and renewable energy."

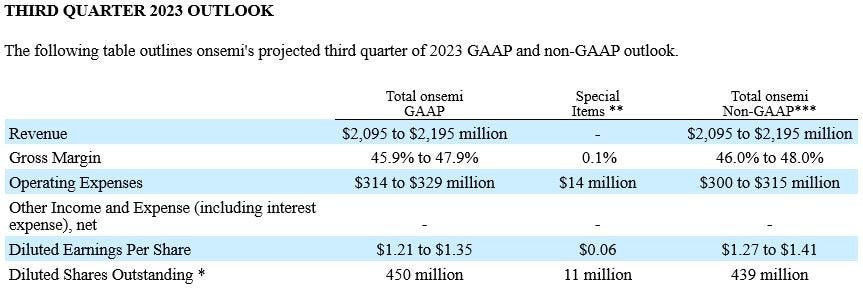

* Diluted shares outstanding can vary as a result of, among other things, the actual exercise of options or vesting of restricted stock units, the incremental dilutive shares from the convertible senior subordinated notes, and the repurchase or the issuance of stock or convertible notes or the sale of treasury shares. In periods when the quarterly average stock price per share exceeds $20.72 for the 1.625% Notes, $52.97 for the 0% Notes, and $103.87 for the 0.50% Notes, the non-GAAP diluted share count and non-GAAP net income per share include the anti-dilutive impact of the hedge transactions entered concurrently with the 1.625% Notes, the 0% Notes, and the 0.50% Notes, respectively. At an average stock price per share between $20.72 and $30.70 for the 1.625% Notes, $52.97 and $74.34 for the 0% Notes, and $103.87 and $156.78 for the 0.50% Notes, the hedging activity offsets the potentially dilutive effect of the 1.625% Notes, the 0% Notes, and the 0.50% Notes, respectively. In periods when the quarterly average stock price exceeds $30.70 for the 1.625% Notes, $74.34 for the 0% Notes, and $156.78 for the 0.50% Notes, the dilutive impact of the warrants issued concurrently with such notes are included in the diluted shares outstanding. GAAP and non-GAAP diluted share counts are based on either the previous quarter's average stock price or the stock price as of the last day of the previous quarter, whichever is higher.

** Special items may include amortization of acquisition-related intangibles; expensing of appraised inventory fair market value step-up; non-recurring facility costs; in-process research and development expenses; restructuring, asset impairments and other, net; goodwill impairment charges; gains and losses on debt prepayment; actuarial (gains) losses on pension plans and other pension benefits; and certain other special items, as necessary. These special items are out of our control and could change significantly from period to period. As a result, we are not able to reasonably estimate and separately present the individual impact or probable significance of these special items, and we are similarly unable to provide a reconciliation of the non-GAAP measures. The reconciliation that is unavailable would include a forward-looking income statement, balance sheet and statement of cash flows by GAAP. For this reason, we use a projected range of the aggregate amount of special items to calculate our projected non-GAAP operating expense outlook.

*** We believe these non-GAAP measures provide important supplemental information to investors. We use these measures, together with GAAP measures, for internal managerial purposes and as a means to evaluate period-to-period comparisons. However, we do not, and you should not, rely on non-GAAP financial measures alone as measures of our performance. We believe that non-GAAP financial measures reflect an additional way of viewing aspects of our operations that, when taken together with GAAP results and the reconciliations to corresponding GAAP financial measures that we also provide in our releases, provide a more complete understanding of factors and trends affecting our business. Because non-GAAP financial measures are not standardized, it may not be possible to compare these financial measures with other companies’ non-GAAP financial measures, even if they have similar names.

Teleconference

onsemi will host a conference call for the financial community at 9 a.m. Eastern Time (ET) on July 31, 2023 to discuss this announcement and onsemi’s 2023 second quarter results. The Company will also provide a real-time audio webcast of the teleconference on the Investor Relations page of its website at http://www.onsemi.com. The webcast replay will be available at this site approximately one hour following the live broadcast and will continue to be available for approximately 30 days following the conference call. Investors and interested parties can also access the conference call by pre-registering here.

This document includes “forward-looking statements," as that term is defined in Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements, other than statements of historical facts, included or incorporated in this document could be deemed forward-looking statements, particularly statements about the future financial performance of onsemi, including financial guidance for the third quarter of 2023. Forward-looking statements are often characterized by the use of words such as “believes," “estimates," “expects," “projects," “may," “will," “intends," “plans," “anticipates," “should" or similar expressions or by discussions of strategy, plans or intentions. All forward-looking statements in this document are made based on our current expectations, forecasts, estimates and assumptions and involve risks, uncertainties and other factors that could cause results or events to differ materially from those expressed in the forward-looking statements. Certain factors that could affect our future results or events are described under Part I, Item 1A “Risk Factors" in the 2022 Annual Report on Form 10-K filed with the Securities and Exchange Commission (“SEC") on February 6, 2023 (the “2022 Form 10-K") and from time to time in our other SEC reports. Readers are cautioned not to place undue reliance on forward-looking statements. We assume no obligation to update such information, which speaks only as of the date made, except as may be required by law. Investing in our securities involves a high degree of risk and uncertainty, and you should carefully consider the trends, risks and uncertainties described in this document, our 2022 Form 10-K and other reports filed with or furnished to the SEC before making any investment decision with respect to our securities. If any of these trends, risks or uncertainties actually occurs or continues, our business, financial condition or operating results could be materially adversely affected, the trading prices of our securities could decline, and you could lose all or part of your investment. All forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by this cautionary statement.